October 2020

It’s Octoberfest season but unfortunately our 2nd Annual Venture Fest will have to wait until October 2021, due to COVID-19. Another HV annual fest, HV Tech Fest 2020 will be held virtually and features a Youth Hackathon with themes Social Distancing and Digital Divide. And for those steeped in entrepreneur ecosystems, you know the pioneer is Brad Feld. Register for Unleashed 2020 (Nov 12) hosted online by Upstate Venture Connect to hear Brad speak, and get a free copy of his new book, The Startup Community Way!

The virus may have limited the face to face gatherings of the Hudson Valley entrepreneur ecosystem, but it has not slowed our progress towards a more vibrant ecosystem, as evident from this October newsletter.

Entrepreneurs

Accel7 and Ulster County Economic Development Alliance (UCEDA) are proud to share our joint program Ulster RESPOND. Together, we are helping small businesses and entrepreneurs throughout the county respond to the 'new normal' of the COVID economy.

The last couple of weeks we garnered some major insights about what’s happening in the Hudson Valley. We focused a session on some of the success we’ve seen in the real estate industry. We spoke to Laurie Osmond and Mark Kanter of the THE MAVERICK TEAM at Berkshire Hathaway HomeServices Hudson Valley Properties and discussed the booming real estate landscape in upstate New York.

Laurie and Mark are both creatives seeing many people and artists coming from the city to settle here, as well as folks from the West Coast, which we found very interesting.

'With people moving up from the city and leapfrogging over the weekender idea, and looking to settle full time, we're finding two things; people that are familiar with the area or people who don't know the area but have heard of it. And as agents, we're saying, 'Well have you thought about this area or that area?' as we look to tackle the affordable housing market'. - Laurie

'This is the most environmentally sustainable region in the entire country; we've got the best land, the best water resources, it's got the most infrastructure. It's the confluence of all those things that has led the people who study climate to invest here'. - Mark

We also spoke with local insurance broker, Bob Ryan of Ryan & Ryan Insurance. We talked about data breaches now that everyone is working from less secure networks at home. As this trend will continue, Ryan is working with both new and current clients to make sure their businesses are protected.

In our last webinar, our partner in the RESPOND program and the Director of Economic Development, Lisa Berger in conversation with John Klassen, Vice President of Commercial Lending at Ulster Savings Bank, discussed funding opportunities within the county.

We learned about how John and the SBDC (Small Business Development Center) work with businesses to help rewrite their narratives, creating a collaborative environment to tell the story of the small business.

We also heard from Fernando Ahumada of the Community Capital NY. By providing loan capital and business development services to entrepreneurs throughout the Hudson Valley, and in Fairfield County, CT, they help create wealth for the business owner, quality jobs, revitalized neighborhoods, tax revenues and community stakeholders. Community Capital New York’s local and timely decisions provide loans for start-up and emerging businesses.

Stay updated and connect by visiting www.ulsterrepsond.com!

For more information, contact Danny Potocki, danny@accel7.org

Investors

Investor Spotlight! Leon Greene moved to Rhinebeck in 2017 and met Hudson Valley Startup Fund co-founder and fellow Rhinebeck resident Johnny LeHane. Leon jumped on the opportunity to to get involved in a community of successful business people and professionals. The interview below is condensed from a recent conversation.

How did you get involved in angel investing and HVSF?

After hearing about the fund from Johnny, I was drawn to the fund's geographic charter for economic development in the Hudson Valley as well as the opportunity to get involved in a great community of like-minded people.

Working with HVSF has been my first substantive experience as an investor. My only prior experience was a couple of opportunistic angel investments I made several years ago.

When I moved here with my family, I was transitioning from NYC, where I'd co-founded and spent the previous 8 years developing a healthcare tech startup called Truveris. I had the good fortune of working with a bunch of really smart people in a hot sector. We built a company that attracted investors and were able to raise a significant amount of capital over several series of venture investments.

In addition to learning quite a bit about building a startup, my experience raising capital as an entrepreneur taught me valuable lessons about partnering with investors and sparked my interest in participating with early stage companies from the investor side of the table.

What's your favorite part of the angel investing process?

Entrepreneurs who make that leap have tremendous energy and belief in what they are doing. That excitement is infectious. I haven't yet found the next venture that would inspire that energy in me as a founder, but through HVSF I've been able to with some founders who have been more than happy to share their exuberance.

The value exchange is that I get to learn about their business and share in their excitement; and they get access to whatever relevant experience, feedback, and insights I may be able to offer. It's a winning exchange from my end whether or not it results in an investment.

What do you wish you could tell entrepreneurs/founders as they're getting started that might help them when they're seeking angel investment?

Ideas don't transform into multi-million dollar valuations because of a snazzy URL, a sharp website, and a perfectly crafted logo. It takes considerable time and effort to develop an idea into a valuable business.

Experienced investors have expectations about what progress looks like. Progress involves milestones that founders can often produce themselves such as market research, financial models, and pitch decks; but also includes milestones that may require other resources such as product development, customer pipeline or contracts. Most importantly, great startups are built by great teams and great teams cost money. It's very difficult to start a business without any capital and very risky to fund it entirely with your own (or family) money.

If you want to raise money, you need to be able to demonstrate not only your passion and personal conviction, but also a team (or beginning of it), a real business plan, and real progress. The more prepared the founders are, the easier it will be to generate interest and the better the valuation will be. For myself, having a million dollar idea is not a high enough bar to ask for a stranger's money.

What sort of opportunities are you looking for?

From the perspective of the Hudson Valley Startup Fund, we're looking for seed and pre-seed stage companies with highly scalable business models and that have touch points in the Hudson Valley. In both cases, we'd expect that the business planning is well underway (financials, market research, go to market plan, etc.). We don't require that companies be producing revenue in order to consider investment.

I also consider personal investment in opportunities that HVSF invests in and, on a more personal note, I would love to find myself actively involved in another startup. Whether joining a founding team that has something interesting brewing or founding a new company myself, I'd like to do some good while building something of real value.

Entrepreneurs and investors seeking more information on the HV Startup Fund can contact Andrew Schulkind, Managing Member, at info@hvstartupfund.com.

For more information about HVSF, please visit our website at www.hvstartupfund.com.

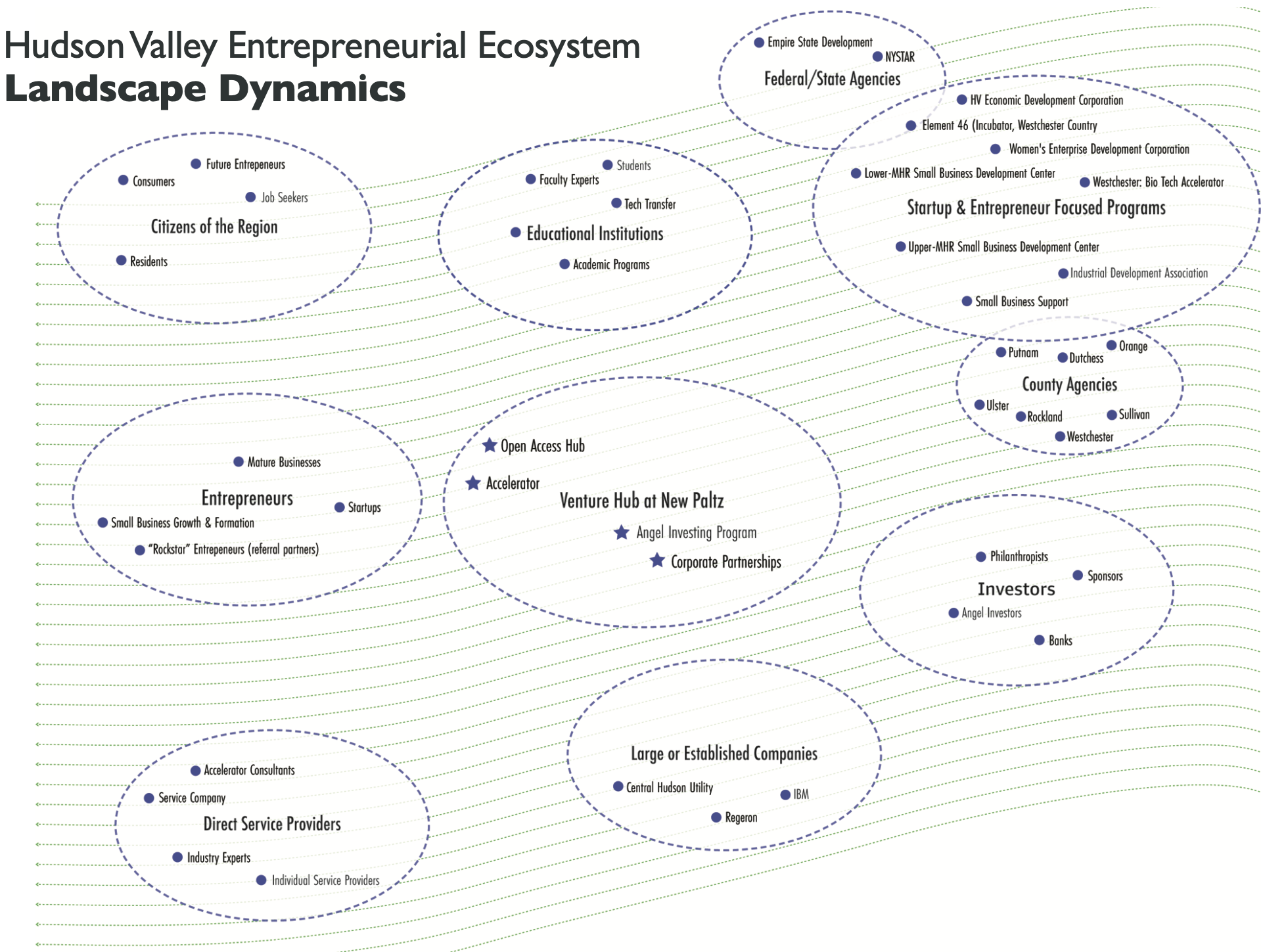

Leaders

Entrepreneurs, when asked what is the most important thing they need from the entrepreneur ecosystem, often reply “money and mentoring”. While the HV entrepreneur ecosystem has made good progress on delivering both of these resources to HV entrepreneurs, there is still more to do and more to come (in the very near future).

Let’s start with money. Circa 2008, there were two active angel networks in the HV: Orange County Angels and Dutchess County Angels. Both ceased operations due to the Great Recession of 2009. The HV was left with a serious gap in the entrepreneur ecosystem. This was resolved in 2016 with the formation of the HV Startup Fund and Westchester Angels. Combined, these include approximately 100 angel investors who have invested approximately $4M in investment capital. A great start, but there is more to be done.

Michael Shuman, in his new book, Put Your Money Where Your Life Is, estimates that accredited investors comprise between 1 to 5% of the US population. Accredited investors are defined as having a minimum combined annual household income of $300K, and/or liquidity of at least $1M. Let’s be conservative and assume 1% of the HV population of 2,060,000 are accredited investors. That’s 20,600 accredited investors in the HV. With 100 active accredited investors, we have tapped less than ½ a percent of the potential accredited investors.

So, yes, we have more to do. And there is more to come. Evergreen Accelerator, an initiative of GCSEN Foundation, is currently launching two funds totalling over $17M. More on the Evergreen Accelerator in the November 2020 newsletter.

Now let’s talk about mentoring. Entrepreneur Magazine (August, 2018 article) highlights that only half of all new businesses survive five year and only ⅓ survive ten years. But the good news is you can increase your odds of success through mentoring. The article cites a study completed by the UPS Store that found mentoring increased the odds of surviving five years to 70 percent.

And how are we doing on mentoring? There is active mentoring across the HV, via the following programs: HV Venture Hub, Accel7, Mid-Hudson Regional Business Plan Competition, HV Startup Fund, SCORE, SBDC, and other existing business networks across the HV. The mentoring through these programs are a great start. But we have more to do and more to come. Before the end of this year, the HV Venture Hub will be announcing an exciting new mentoring program. Stay tuned!

Service Providers

FuzeHub helps you to solve business and technical challenges. Whether you’re a New York State startup or an established manufacturer, we can connect you to public, private, and university-based resources. We also provide programs, funding opportunities, and a full calendar of events. As New York’s statewide Manufacturing Extension Partnership (MEP) center, our mission is to assist small-to-medium manufacturers. Yet, FuzeHub also supports technology companies and the innovation ecosystem itself.

Headquartered in Albany, FuzeHub is a non-profit organization with a broad portfolio of services and a statewide footprint. For example, our Manufacturer Solutions Program can provide you with guided access to a network of resources that includes approximately 75 assets funded by NYSTAR, the Division of Science, Technology, and Innovation within Empire State Development (ESD), the largest economic development organization in New York State.

When you contact FuzeHub for assistance, we can connect you with NYSTAR assets such as Centers for Advanced Technology (CATs), Centers for Excellence (COEs), incubators, hotspots, and your regional MEP center. CATs and COEs are university-based and provide deep technical expertise. Incubators and hotspots help early-stage companies innovate and grow. New York State’s 10 regional MEP centers deliver services such as lean training and, like FuzeHub, can help you to forge supply chain connections.

FuzeHub also hosts Solutions Forums, physical or virtual events that let you meet resources in a match-maker style format. Cybersecurity assistance in the form of webinars, workshops, and grants are available for members of the defense supply chain. For manufacturers with COVID-19 challenges, the Manufacturing Reimagined Fund can help pay for a project with a NYSTAR asset. For early-stage companies, our Build4Scale NY program is helping with prototyping and scale-up.

For startups and established manufacturers alike, FuzeHub’s Jeff Lawrence Innovation Fund can also support growth. The Fund’s Manufacturing Grants are designed to encourage collaboration between not-for-profit organizations and companies in the manufacturing industry. The Fund’s Commercialization Competition awards entrepreneurs who win a pitch competition. For the innovation community, FuzeHub is also hosting a NYSTAR Innovation Asset Showcase this year.

To learn more, see FuzeHub Profiles and contact info for Steve Melito and Everton H. Henriques or email info@fuzehub.com.

Before Silicon Valley, The HV

By Donald J. Delaney

Bricks & Mortar - the Hudson Valley builds NYC

Source: history.com

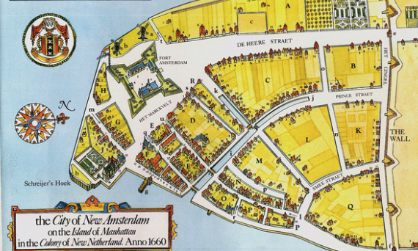

New York City is built on a 193,280-acre entrepreneurial canvas. The real estate, businesses and civic enterprises that filled in the canvas required massive and constant supplies of material resources to grow. It’s worth mentioning, Manhattan was conceived by the Dutch East India (VC fund) as a startup high-growth business venture. An investment that delivered 20% annual returns, for over 200 years to the investors.

Source: archives.nyc

The British, who succeeded the Dutch (1673), used a market business model. British finished goods in, raw goods out. Market models thrive on logistics, the movement of goods. The innovation and introduction of steam power marine transportation by Fulton and Livingston (1807) gave logistics two new tools: predictability and speed. The speed of commerce took off. In the first half of the 19th. century; New York was the fastest growing city in America with a population of 500,000+ inhabitants.

Entrepreneurs and entrepreneurship thrive on solving ‘wicked’ and scalable problems.

- Wicked problem #1: the War of 1812 cut off coal shipments to New York.

- Wicked problem #2: closely packed wooden buildings were creating massive fires.

The Great Fire of 1845. Source: Library of Congress

The Hudson Valley provided a cascade of entrepreneurial solutions, with help from nature: Transportation, Energy, Mortar, Bricks, Water

1807: Fulton and Livingston in Columbia County leveraged the invention of portable steam power to marine transportation on the Hudson River. The leap from wind power to steam power introduced the logistical benefits of reliability and speed. Manhattan grew, the Hudson River economy prospered. (See May 2019 Newsletter)

1823: The Wurts Bros. of Philadelphia became Hudson River entrepreneurs. The War of 1812 brought a war-imposed coal embargo and energy crisis. William and Maurice Wurts’ entrepreneurial response was to mine high-grade coal in Pennsylvania for delivery to New York, a 198-mile journey. Their solution required them to raise $ 22,000,000 (in 2020 dollars) to:

- Start up the Delaware and Hudson Canal Company

- Create a new coal mining business in Northwestern Pennsylvania

- Build a 108-mile, 108 lock uphill canal system, in less than two years

- Invent, innovate and fabricate marine masonry, bridge and lock construction, engineer a transformation from animal power to steam power, and then use the first steam powered locomotive in America

- The last leg of the journey was to transship thousands of tons of coal from barges to boats in Kingston, NY, for transport via the Hudson River to cold customers in New York and Albany

- (See September 2020 Newsletter)

MORTAR

1826: Excavating the new canal unearthed the discovery of natural (hydraulic) cement in Rosendale, located in the Hudson Valley - a very timely find. Construction of the canal created new demand for a new product, marine masonry cement. ‘Scaling’ is an important component for entrepreneurial business growth. Rosendale Cement Co. scaled from one cement works producing 500 barrels a day to 16 cement works producing 600,000 barrels a day in the 1840’s, and employed 5,000 workers. Rosendale Cement achieved a 25% market share. Production continued for 150 years.

Source: rosendalecement.net

Thus, Hudson Valley mined cement was used in the construction of the Brooklyn Bridge, Statue of Liberty, U.S. Capitol, Delaware & Hudson Canal, Croton Aqueduct, New York Thruway, and in NYC as a fireproof, strong, economical building material combined with Hudson Valley bricks.

Hudson Valley bricks are the subject of the November 2020 HV Venture Hub Newsletter.

Source: scenichudson.org

The abandoned mines were repurposed several times in the 1950’s by entrepreneur Herman Knaust, as Iron Mountain, as a mushroom farm, and repurposed a third-time, as Iron Mountain Secure Storage, an international ultra-secure storage company. Widow Jane, an artisanal bourbon whiskey startup in Rosendale, NY takes its name from the famous Widow Jane Mine.

This Before the Silicon Valley, the Hudson Valley blog offers a 400-year narrative journey honoring the icons of entrepreneurship and their impact on invention, innovation, and commercialization in the Hudson Valley.

Contact welcome: Donald J. Delaney, HV Entrepreneurship Historian & Blog Writer for the HV Venture Hub at SUNY New Paltz. You can reach Don at don@dondelaney.com

© Donald J. Delaney 2020

Events

- Starts October 5th (Zoom): Navigating Conflict - six-week workshop, 7:00 - 9:00pm, hosted by Good Work Institute, led by Nicole Bauman

- October 12 (in person): Outdoor Networking, 1-2:30pm, hosted by Hudson Valley Women in Business

- October 14 (Zoom): E-Commerce Part 1, 12:30pm-1:30pm, hosted by Community Capital NY, led by Chris O’Neal Design

- October 19 (Zoom): Virtual Retreat & Strategy Session, 9am-12pm, hosted by Hudson Valley Women in Business

- October 22 (Online): Invest NY: Energy, Transportation and Impact, hosted by Upstate Capital

- October 23-24 (Online): HV Tech Fest 2020, featuring a Youth Hackathon with a focus on Social Distancing and Digital Divide, hosted by the Open Hub Project

- October 28 (Zoom): E-Commerce Part 2, 12:30pm-1:30pm, hosted by Community Capital NY, led by Chris O’Neal Design

- October 28 (Zoom): Resilience & Planning for the Winter, 6pm, co-hosted by Hudson Valley Women in Business and HV Tech Meetup

- November 12 (Online): Unleashed 2020, 10am-1pm, hosted by Upstate Venture Connect, see Schedule

- December 9 (Rochester): Upstate Capital 5th Annual Celebration & Awards event to celebrate the investment ecosystem across New York

Comments? Email Tony DiMarco at dimarcoa@newpaltz.edu

Newsletter Archive: | March 2019 | April 2019 | May 2019 | June 2019 | July 2019 | August 2019 | September 2019 | October 2019 | November 2019 | January 2020 | February 2020 | March 2020 | April 2020 | May 2020 | June 2020 | July 2020 | August 2020 | September 2020 | October 2020 | November 2020 | February 2021 | March 2021 | April 2021 | May 2021 | June 2021 | July 2021 | August 2021 | September 2021 | October 2021 | November 2021 | December 2021 | January 2022 | February 2022 | March 2022 | July 2022 | August 2022 | February 2023