July 2019

Please SAVE THE DATE: October 17 (1:00pm-6:30 pm) at SUNY New Paltz for a major event that will include the broad HV entrepreneur ecosystem (entrepreneurs, service providers, leaders, investors, students, and interested parties). As a recipient of this newsletter, you are a part of the HV entrepreneur ecosystem, even if you are only an interested observer. This will be our first annual major event, so we are thinking big! We are planning an exciting program with a fun Oktoberfest theme for up to 500 attendees. More details to come in the next few months.

Please forward this newsletter to others so they can Subscribe and enjoy it as well.

Entrepreneurs

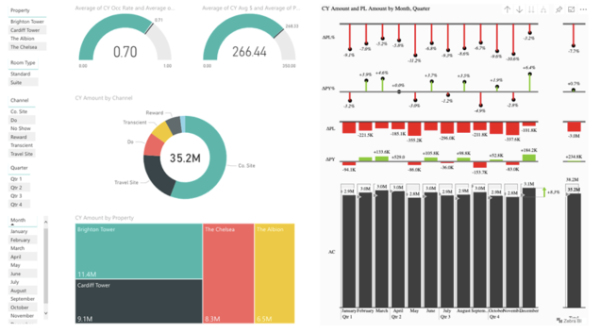

Ready Books Group, Inc. (RBG) has developed enterprise-class financial performance management software on Microsoft’s Azure Platform. RBG has decades of experience in designing and managing complex financial systems. After working with one of the most complex casino resorts in the world, RBG is launching its first industry vertical - large resorts and casinos. Partnering with David Dell and the team of Schwartz Heslin Group, RBG is currently positioning ReadyBooks Hospitality Performance Management for release.

Reporting and Analysis tools include business user-focused Performance Management reports with dynamic dashboards that can be refreshed every five minutes, hourly, daily, sub-weekly, weekly or monthly. Advanced graphical Dashboards offer drill through to detailed activity level reporting that feature accounting quality control tools. Integrating with operational business applications assures one source of truth for trusted and managed transactional level data reporting and analysis. IT data and operational management support tools are pure Microsoft and can be installed on-premise, in-cloud or as a hybrid solution.

Leveraging years’ of experience in extreme-luxury and mega-resorts industry,

For more information please contact ron.sella@readybooks.software.

Investors

If you’re a high-growth entrepreneur in the Hudson Valley, the Hudson Valley Startup Fund wants to hear from you.

HVSF provides capital to early-stage startups throughout the region. Please reach out to us if you seek angel funding.

Even if you’re not quite ready to seek outside funding, HVSF is committed to supporting a culture of entrepreneurship in the region. We may be able to help you with introductions or mentorship.

What types of companies are good candidates for funding from the HV Startup Fund?

HVSF is focused on finding companies where investment and mentorship will accelerate growth.

-

Hudson Valley-based - you have some meaningful part of your business here (e.g. HQ, marketing, tech, operations).

-

Scalable business model - you have the potential for significant growth, typically with a national or global market

- Production prototype - you have a production quality prototype and are in the early stages of engaging your target market to demonstrate market traction (i.e., clear market demand for a solution to a problem).

-

Revenue - some initial level of revenue is desirable but pre-revenue will still qualify

-

Strong team - we invest in people who can execute, and who value our approach to active angel investing

-

Right to win - unique technology or another strategic competitive advantage within the business

-

Path to exit - the potential for realizing returns through acquisition, merger, etc.

If you meet the requirements above, you are typically considered a Seed Stage company. For Seed Stage companies, HVSF invests up to $250k per company, typically staged with milestones and in the form of convertible debt.

If you are earlier stage (i.e., cannot yet meet the requirements above), we can still consider you for a smaller Pre-Seed Stage investment, typically in the $10,000 to $50,000 range.

Next month we will highlight the process - what are the steps from initially reaching out to HVSF to the point

If you have questions or would like more information about HVSF, please contact info@hvstartupfund.com.

Leaders

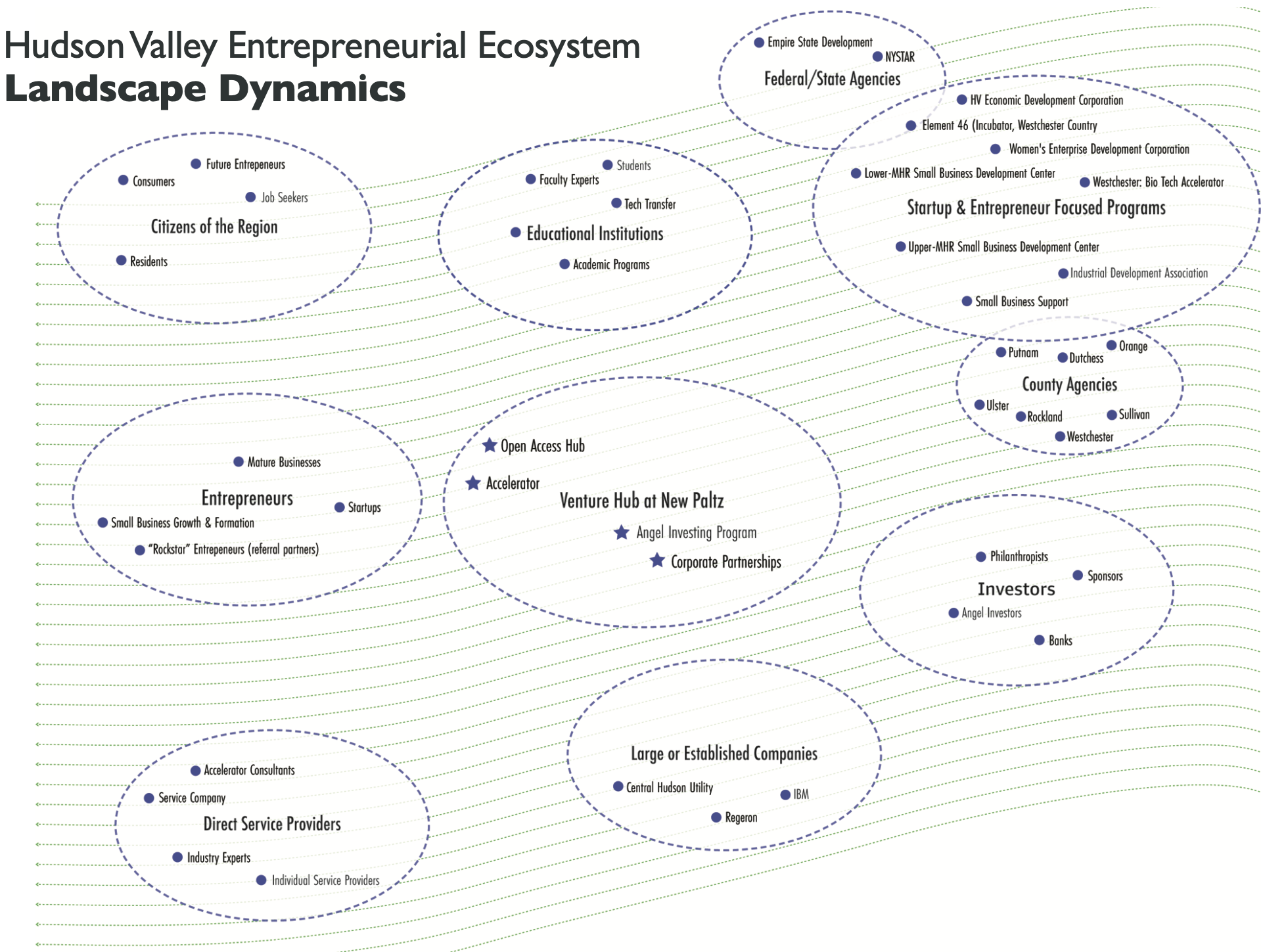

We’ve been highlighting a “Leader” in each of our past newsletters. It’s high time we explained who these Leaders are. A critical mission of the HV Venture Hub is to connect up the HV entrepreneur ecosystem. With the geographic fragmentation of the HV, it is important to bring together like-minded people who don’t often just bump into each other. We currently have 120+ Leaders, individuals who are passionate about directly helping HV entrepreneurs.

Leaders support HV entrepreneurs through specific initiatives, programs, or offerings such as funding, incubators, co-working spaces, accelerators, maker spaces, teaching entrepreneurship, business plan competitions, events, and platforms.

The HV Venture Hub has now hosted four Leaders’ Forums with the most recent in June 2019. The Forums are highly interactive (i.e., no presentations) with Collaboration Corners where four different Leaders host a table discussion so other Leaders can get to know them and their offering(s) and can find ways to help them succeed (see photo - each table is a Collaboration Corner).

During the June 2019 Forum, we added an Entrepreneur Panel with the following panelists, from left to right in the photo above.

- Charles Graham, Founder, Poeia – self-funded to date, seed round or Security Token Offering (blockchain)

- Geoff Green, Founder, Really – self-funded to date, seed round

- Reva McPollom, Founder,

Lessonbee – self-funded to date, pre-seed round - Dennis Roche, Co-Founder, Burbio – seed round funded

Some key insights from this panel:

- Each found it challenging to go “full time” with their startup after bootstrapping the initial phase - feels like “jumping off a cliff.”

- You have to know when to go after funding so you don’t get distracted from building the solution and getting it into the market.

- The talent for your team is here in the HV, but you have to scour for it.

- When asked what they needed most, each responded that specific connections are the most valuable - connections to prospective clients and connections to other entrepreneurs that are slightly ahead of them to convey their lessons learned.

As a result of this panel, the HV Venture Hub plans to create more opportunities to connect HV entrepreneurs to each other. The first such opportunity will be on October 17 at our major ecosystem event at SUNY New Paltz. More details to come.

If you directly support HV entrepreneurs and are not already a Leader, please contact Tony DiMarco, dimarcoa@newpaltz.edu

Service Providers

Schwartz Heslin Group, Inc. (SHG) specializes in three practice areas: Investment Banking, Strategic Advisory, and Valuation Services. As Trusted Advisors, SHG helps clients protect and increase their value at various stages of their business, including emerging growth companies, with services such as Merger and Acquisitions, Capital Raising, Financial Plan Review & Formation, Go-To-Market Strategy Deployment, and professional grade Valuation. SHG is headquartered in the capital region and actively supports HV entrepreneurs. David Dell, Managing Director, located in Poughkeepsie, is currently working with HV startup, Ready Books Group Inc., highlighted in the Entrepreneur column.

SHG focuses on helping to solve the unique and complex issues of high growth businesses, providing advice to founders, core team, and boards of directors, regarding issues of great strategic and financial importance to them.

As an example, one such founder was seeking to retain and attract superior talent by offering an equity option plan for their key management. SHG’s client had been experiencing over five years of double-digit annual revenue growth and as such required significant investment in its personnel resources to manage an ever growing business. As the company continued to grow and double in size to more than 300 employees, the founder determined a need to attract new top-tier talent while retaining key existing personal. SHG was hired to assist in the implementation of an equity ownership plan, the most common form of which is an employee stock option plan. Continued growth without an ability to attract talented team members would risk the company’s ability to meet its growth initiatives.

For more information, please see Contact Us.

Before Silicon Valley, the HV

By Donald J. Delaney

Wonk Alert - 0’s and 1’s Ahead

F.B. Morse Part II

Samuel Morse was a super connector. His multi-discipline curiosity powered creative connections between ideas, material, and people. He conceived science-based inventions creating both long-distance telecommunications, and, the early building blocks that would eventually construct twenty-First Century computers - a way to code using zeros and ones.

Morse was an inventive inventor, often dubbed the ‘American Leonardo’. His creative process pulled from many scientific silos to design solutions and develop new devices. His multi-discipline mindset produced these inventions:

- Transmitting binary bursts of electrical energy through a single strand of wire over long distances.

- A symbolic language, Morse Code, to give dashes and dots a voice. And, an alphabet to communicate when paired with the telegraph -- the precursor to binary (computer) programming code.

- A paper tape recording device, a precursor to computer punch cards.

Morse’s genius set the table for the computer age. In the mid-1800s, sending a pulse of electric current through the wire was known, but had no practical application. Morse ’shaped’ the pulse into a dot (.) and a dash (-). In the next cycle of innovation, Morse’s dot and dash became 0 and 1. 0 and 1 is the basis for binary code, and binary code is the original programming language. 0 and 1 is the super connector.

0 and 1 electrical pulses are the ink of data transmission, and the addition of paper transformed it into a tool and a code. Morse cleverly borrowed bits from watchmaking to invent a paper roll recorder. In another cycle of innovation, voilà, appeared the invention of the punch card.

In a twist of historical irony, one-mile south of Samuel Morse’s beloved Locust Grove on Route 9 in Poughkeepsie, IBM built its main plant in 1948. IBM championed the punch card and later magnetic memory- the storage of 0’s and 1’s.

This Before the Silicon Valley, the Hudson Valley blog offers a 400-year narrative journey honoring the Icons of entrepreneurship and their impact on invention, innovation, and commercialization in the Hudson Valley.

Contact welcome: Donald J. Delaney, HV Entrepreneurship Historian & Blog Writer for the HV Venture Hub. You can reach Don at don@dondelaney.com

© Donald J. Delaney 2019

Events

- July 15 (Piermont, NY): Women’s Business Summer Networking Event at Pier 701 restaurant featuring Sharon Rowe, author of The Magic of Tiny Business.

- July 25 (Online Roundtable): Grant Writing Essentials (Part 2 - The Commercialization Plan) hosted by Westchester Biotech Project

- June - August: Strategies for Running a Successful Business - a series of short courses over this summer at SUNY Westchester

- August 7 - 8 (Saratoga): Saratoga Forum, 12th annual Forum hosted by Upstate Capital, for CEO/Founders and investors

- August 12 (New Paltz): Hudson Valley Women in Business (HVWiB) monthly meeting

- September 9 (Newburgh): Hudson Valley Women in Business (HVWiB) monthly meeting

- September 12 – January 30, 2020: 60 Hour Entrepreneurial Training Program. Do you have a business idea and don’t know where to start? Have you started a business and need help with what to do next? Then our program is for you!

- October 11: Hudson Valley Tech Festival is now accepting speakers and participants to showcase regional tech businesses and talent. Contact Yulia Ovchinnikova at festival@openhubproject.com

- October 17: SAVE THE DATE for our 1st Annual HV Entrepreneur Ecosystem Event

- November 22 (Valhalla): Grow Your Business Conference at the Westchester Community College

Newsletter Archive: | March 2019 | April 2019 | May 2019 | June 2019 | July 2019 | August 2019 | September 2019 | October 2019 | November 2019 | January 2020 | February 2020 | March 2020 | April 2020 | May 2020 | June 2020 | July 2020 | August 2020 | September 2020 | October 2020 | November 2020 | February 2021 | March 2021 | April 2021 | May 2021 | June 2021 | July 2021 | August 2021 | September 2021 | October 2021 | November 2021 | December 2021 | January 2022 | February 2022 | March 2022 | July 2022 | August 2022 | February 2023