FEBRUARY 2023 NEWSLETTER

This month our contributors are thinking about business ethics and how that applies to investment, marketing and more.

Entrepreneurs

The collapse of crypto currency exchange FTX and the arrest of Sam Bankman-Fried could end up being just another tale of a charismatic entrepreneur with less than scrupulous ethics.

According to numerous news reports, FTX funneled billions of client dollars into a privately-held hedge fund, sister company Alameda Research, and not into crypto holdings to own and trade. Among other things, Federal investigators claim, Bankman-Fried used some of the money to curry political favor and fame, and fund a lavish lifestyle.

While the scale of FTX’s fraud is enormous, the alleged shell game is far from unusual, a story all too common in the world of entrepreneurship. JP Morgan Chase recently filed a lawsuit against Charlie Javice, the 30-year-old founder of the college tuition assistance company Frank. JP Morgan Chase alleges Javice intentionally misrepresented the number of Frank’s student clients and the scale of the education institutions it was offering online classes from.

Entrepreneurs like Bankman-Fried and Javice are often deified by the media and others, without anyone really vetting their qualifications. My LinkedIn newsfeed is filled with quotes and inspiring leadership stories from charismatic business founders.

What I see much less often on LinkedIn is a frank and open conversation about business ethics.

Take for example how most people view Adam Smith, the 18th century Scottish economist and author of “The Wealth of Nations.” Smith is mostly recognized as the standard bearer for unfettered capitalism, the invisible hand of the free market, and a concept called “doux commerce.”

How many times have you seen a LinkedIn post quoting Smith thus: “It is not from the benevolence of the butcher, the brewer or the baker that we expect to eat our dinner, but from their regard to their own interest."

In his beloved “Wealth of Nations,” Smith noted how self interest promotes ambition, innovation, wealth creation.

But what too many students of business (those who have graduated and those still matriculated) forget is that Smith also was a philosopher. Seventeen years before he penned “The Wealth of Nations, he wrote “The Theory of Moral Sentiments.”

In this book, Smith called out human nature as prone to unethical behavior. He cautioned those who leaned too heavily on “self-interest” to not overlook how powerful self-interest can be in turning humans away from ethical business practices.

Essentially, Smith believed that success and all its trappings can be incredibly tempting.

Bankman-Fried was the darling of the business press and sought after in halls of power. In 2019, Javice appeared on Forbes’ 30 Under 30 finance list, and Crain’s New York Business’ 40 Under 40 list. Heady stuff indeed. Enough to make them bend the truth?

There’s no guarantee, but ideally the truth behind these narratives would come to light in the courtroom. If you’re planning on being in the gallery, do yourself a favor – bring a copy of Smith’s “Theory of Moral Sentiments” in case the wheels of justice turn slowly.

Richard D'Ambrosio helps businesses and organizations define their brands and amplify their voice through his 30 years of practicing the art of storytelling. You can find him at www.storytellingthatsells.biz, where he helps entrepreneurs, non-profits, large organizations and companies translate their stories into powerful marketing content, including social media, websites, blogs and video.

Richard D'Ambrosio helps businesses and organizations define their brands and amplify their voice through his 30 years of practicing the art of storytelling. You can find him at www.storytellingthatsells.biz, where he helps entrepreneurs, non-profits, large organizations and companies translate their stories into powerful marketing content, including social media, websites, blogs and video.

Investors

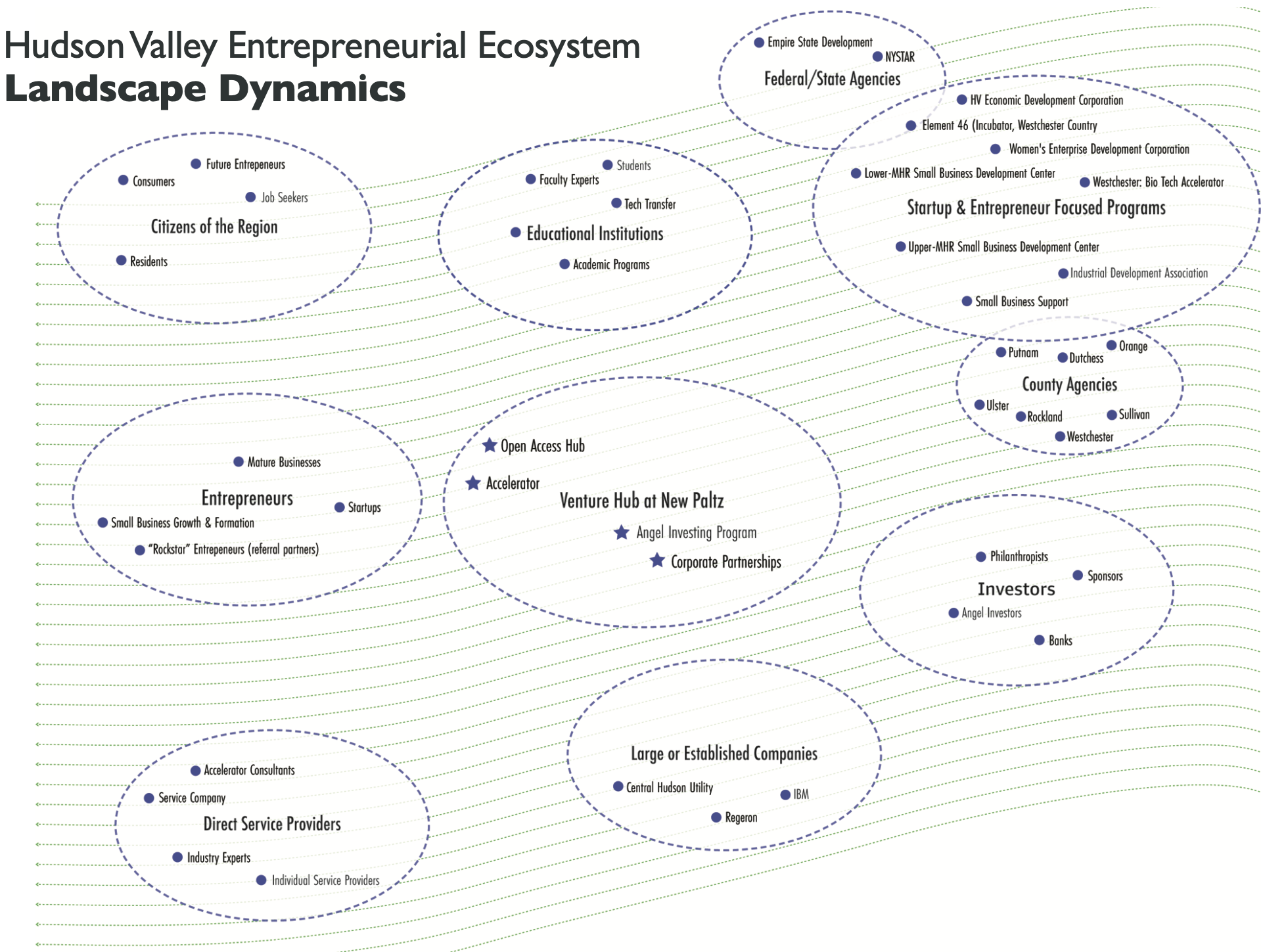

Assuming our readers share a common interest: growing regional business and entrepreneurship, then ethical investing should also be a priority. The idea is that we can generate a meaningful impact and profit by investing in companies that share our own values and ethics - which might just mean that they are improving the economy of the Hudson Valley.

Hint to any entrepreneur pitching a local investor, you might want to include some impact metrics in your story. What are these impact metrics? At GCSEN Foundation, we call it 4P Impact - People, Planet, and Place impact, sustained by Profit. Of course your business needs to be profitable, otherwise, investors, even impact investors, would not be interested. And without that profit, you cannot sustain the social impact you want to make. Think of different ways to make a positive impact on People, Planet and Place. There are numerous ways to impact each category. These are your social impact metrics. Show your future shareholders that by putting their capital into your company, they’ll also be creating a positive social (or maybe even environmental impact).

So how do you pitch the ethical investor? Want to find out how to be an ethical and local investor? Join the HV Angel Hub membership. The purpose of HV Angel Hub is to vastly increase the number and diversity of educated angel investors in our region. The education will be delivered through monthly meetings, alternating in-person and online each month.

Our first in-person meeting is Thursday, February 9th from 6:00-7:30 pm at The Terrace on the SUNY New Paltz campus. The meeting will kickoff with networking followed by a 15-minute pitch by Greg Perlman, LCSW, Founder and CEO, Engage Play Therapy. The pitch will be followed by a 15-minute Q&A, and then a discussion of lessons learned from an investor and entrepreneur perspective about the pitch. The meeting will wrap-up with another opportunity for networking while enjoying some nice hors d'oeuvres and drinks. If you are interested in attending as a guest, please email Eliza Edge (edgee@newpaltz.edu).

Tony DiMarco, Founding Manager, HV Startup Fund. Tony has been educating startup founders since 2016 in his role at GCSEN Foundation. He co-founded the HV Venture Hub and is a Program Manager for HV Angel Hub. He is also the founder of Natural Roles, LLC, a career coaching company.

Tony DiMarco, Founding Manager, HV Startup Fund. Tony has been educating startup founders since 2016 in his role at GCSEN Foundation. He co-founded the HV Venture Hub and is a Program Manager for HV Angel Hub. He is also the founder of Natural Roles, LLC, a career coaching company.

Service Providers

You might remember Hudson Valley Entrepreneur, Shanley Harruthoonyan, when pitched her startup at Venture Fest 2021, called ABLE Ecosystems and won a cash prize in participating. She continues her complex work around supply chain traceability - actually she has since established a partnership with the Rwanda leather value chain union, which will provide us with 300 volunteers to deploy a pilot in Rwanda later this year (talk about ethics!)

In addition to building ABLE, she has launched another company, this time a service to help entrepreneurs with their branding. Her new company, Rare Animals is a content studio built to serve early-stage startups and small businesses that put people and planet first.

This first offering is a 3-month, beta subscription that sets up your messaging and tone of voice, and then scales it across unlimited kinds of content. Rare Animals start with a streamlined, strategic process that helps our users quickly pinpoint their key value and distinction. Then, they use conversational natural language processing tools, together with their hands-on support, to develop copy that's on brand and on voice.

You can view more details at rareanimals.co/membership with the password: newmember.

While we wish Shanley luck with this new company, we're also excited to announce that she'll be a monthly contributor to the Venture Hub newsletter, as we move this column into one that explores and discusses interesting and innovative companies in our region.

Before Silicon Valley, the HV

Frederick Philipse (1653).

The First Entrepreneur Unicorn – Billionaire

Part 2

Starbucks is an iconic and inspiring entrepreneurial success story. And a perfect meeting place to hear about a new local entrepreneurial success story in the making. Across the table is my host, Tony DiMarco, then teaching entrepreneurship at SUNY – New Paltz (2016). He shares with me an enthusiastic vision for inspiring entrepreneurship in the Hudson Valley. His ask was to create an inspirational and educational blog. Before the Silicon Valley, the Hudson Valley was created - 42 blogs have been published to date.

As the ‘Before…’ blog begins a strategic transition, let me introduce Frederick Philipse (1653) An inspiring entrepreneur before entrepreneurship, a liver of the American dream before there was an America, and an early unicorn-billionaire.

Frederick Philipse was born in the hinterlands of Holland into a demi-royal family, high in status and low in funds meaning no schooling for Frederick. In his teens, he took up being an apprentice carpenter-roofer. Early on, he demonstrated the entrepreneurial traits of ambition-independence, a curious learner, and being resourceful. He inherited social intelligence and an eye for beauty from his parents. Good manners and an aesthetic eye for quality would be his superpower.

In 1646 Frederick, a strategic thinker, took stock of his early adult options. The West India Company was the alpha employer for a twenty-year-old male: carpentry, opportunity, and adventure no doubt checked his boxes. With no money nor friends, Frederick set sail for New Netherlands.

Now on the WIC payroll, Frederick built an admirable reputation for both the quality of his work and his social graces. Demand for iron nails triggered his entrepreneurial traits. Frederick added a side gig iron nail merchant to his expanding career menu.

Product, market fit, and good timing create favorable entrepreneurial conditions for profits. Frederick built on these three entrepreneurial elements to build wealth and status in the New Amsterdam economy. As Frederick transitioned from his twenties to his thirties, he was a high-functioning, in-demand entrepreneur: a builder, real estate developer, tavern owner, and civic leader.

Reid Hoffman, a notable startup entrepreneur (PayPal & LinkedIn), writes on breakthrough opportunities and their effect on career entrepreneurs. One small example he cites is sixteen-year-old Steve Jobs calling David Packer, Co-Founder of HP, for spare parts and a summer job - a breakthrough opportunity.

Frederick, the serial entrepreneur, was a proactive breakthrough opportunity maker. His model was to build a portfolio of startups for current cash flow, invest in hard assets (land*) for long-term appreciation and wealth, and attach resource-rich partners (spouses). Fredrick’s algorithm = $1,000,000,000+ in 2000 dollars.

* One of Mr. and Mrs. Philipse's prize land assets was the Bronx and Westchester County.

And he found time to father 11 children. Inspiring.

As Steve Jobs likes to say… There’s one more thing. There is much more to this Bio-Blog lesson. Stay tuned.

Contact welcome: Donald J. Delaney, HV Entrepreneurship Historian & Blog Writer for the HV Venture Hub at SUNY New Paltz. You can reach Don at don@dondelaney.com, 845-264-1505

© Donald J. Delaney 2021

This Before the Silicon Valley, the Hudson Valley blog offers a 400-year narrative journey honoring the icons of entrepreneurship and their impact on invention, innovation, and commercialization in the Hudson Valley.

Current Opportunities

Events

- February 2, Westchester County Life Sciences Spotlight Event, 9am, Email Deborah Novick for details dnovick@westchestergov.com

- February 2, All Access Healthcare - Regional Life Sciences Outlook - Westchester Business Development, Public Policy Issues & Reform | Westchester County Association 8.30am - 10am Presented by Westchester County Association and Westchester County Office of Economic Development

- February 2, Preparing for Entrepreneurship: Data What does the innovation community expect? 5:30pm - 6:30pm, presented by FirstXFounder and WCBA/ Westchester County Biosciences Accelerator

- February 9, Westchester Angels investor Meeting, 5:30pm, held at Rye Bar and Grille

- February 14, Entrepreneur Growth Lab, 6:00pm – 9:00pm, Hybrid (in-person classes are held at Dutchess Community College in Poughkeepsie, NY), hosted by Women’s Enterprise Development Center

- March 31, 2023. 11th Annual Mid-Hudson Regional Business Plan Competition, held at Marist College, hosted by the School of Computer Science and Mathematics

- April 27, 2023. NY State Business Plan Competition Finals

- For more information contact Cynthia.Worrad@marist.edu or Roberta.Diggins@marist.edu

Opportunities for Founders

- NYS State Small Business Credit Initiative is providing $30 million for the Pre-seed and Seed Matching Fund Program.

- BarnBurner by Sweater Ventures, pitch for $500k investment, applications close February 3rd

- Hudson Community Incubator is launching its 2023 cohort, apply this February.

Hudson Valley Founder Asks

- 2Ft Design Data, a SaaS-based tool is looking for pilot clients who are developers or entrepreneurs interested in acquiring real estate, contact Rebeeca at rph@2ftdesigndata.com

- Engage Play Therapy is looking for 10-20 clinicians that want to be long-term beta testers for the telehealth platform with embedded games, contact Greg at greg@engageplaytherapy.com

Comments? Email Kris Backhaus at backhauk@newpaltz.edu

Newsletter Archive: | March 2019 | April 2019 | May 2019 | June 2019 | July 2019 | August 2019 | September 2019 | October 2019 | November 2019 | January 2020 | February 2020 | March 2020 | April 2020 | May 2020 | June 2020 | July 2020 | August 2020 | September 2020 | October 2020 | November 2020 | February 2021 | March 2021 | April 2021 | May 2021 | June 2021 | July 2021 | August 2021 | September 2021 | October 2021 | November 2021 | December 2021 | January 2022 | February 2022 | March 2022 | July 2022 | August 2022 | February 2023